Building Next Generation Healthcare: The ATV Model

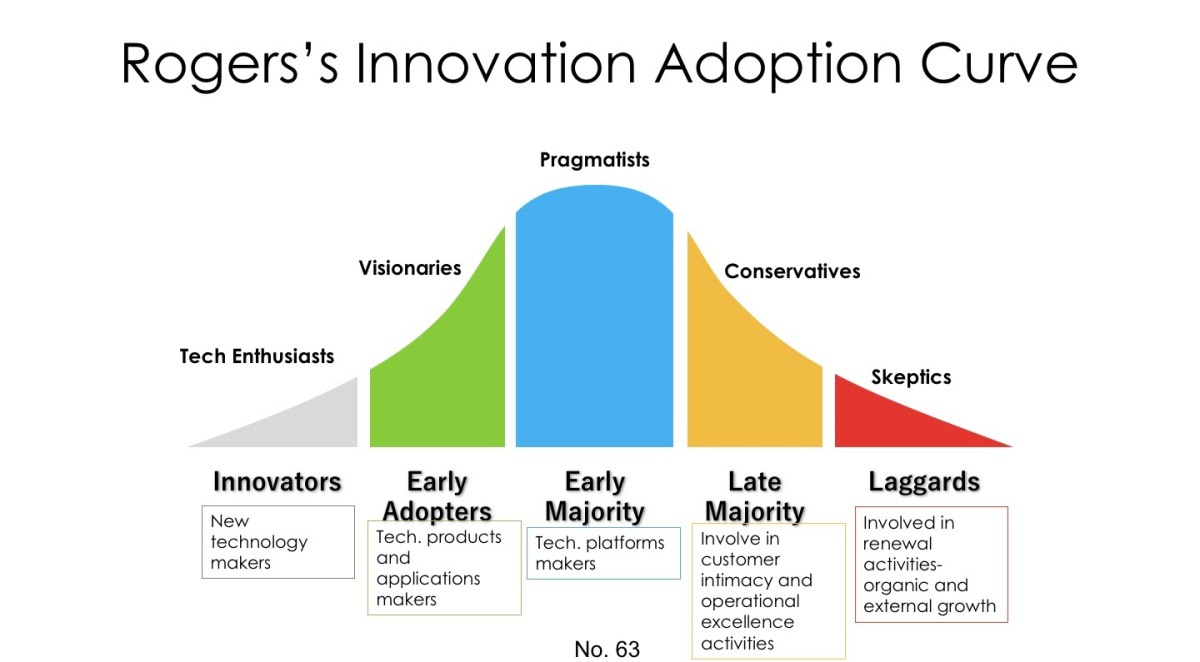

Healthcare lags other industries when it comes to innovation. The tendency is to be conservative or skeptical—to live on the far right of the Innovation Adoption Curve. The reasons are valid and myriad, but the end result is the same: nothing changes.

How do we operate on the left-hand side of the curve as tech enthusiasts (innovators) and visionaries (early adopters) without compromising patient safety or clinical quality? Where are the opportunities to meaningfully impact the future of healthcare?

I'm no management consultant, but strategic thinking and framework development are indispensable tools when approaching a difficult problem like healthcare. The key, as always, is marrying the 10,000-ft view with the 10-ft one. Large-scale thinking ensures systemic impact and integration across layers. Small-scale thinking bridges the gap between strategy and execution.

Sustainable healthcare evolution requires identifying macroscopic trends early and adopting them ahead of the curve.

This week’s edition of The Surgeon’s Record presents a new strategic framework for next-generation healthcare: The ATV Model.

This model leverages the three pillars shaping healthcare’s future:

Ambulatory — The shift to outpatient centers and low-cost sites of service

Technology — Purposeful use of AI, digital tools, and novel clinical technologies like robotics and advanced imaging

Value — Reduced costs, improved outcomes, and sustainable payment models

Together, these pillars form the foundation of a better system: safe, cost-effective, high-quality, tech-enabled, scalable, and reproducible.

A is for Ambulatory

The site-of-service shift is well underway (and accelerating). Surgical procedures once performed exclusively in hospitals—joint replacements, spinal fusions, and interventional gastrointestinal/cardiology procedures—are now routinely done in ASCs. According to MedPAC, the volume of Medicare FFS surgical procedures performed in ASCs rose 5.7% in 2023. Sg2 predicts that ASC volume will grow to 44 million total procedures between 2024 and 2034, a 21% increase.

The trend is key to the long-term strategy of several large healthcare incumbents. UnitedHealth’s Optum acquired ASC company Surgical Care Affiliates (SCA) in 2017. Meanwhile, both Tenet and Ascension are divesting their hospital assets in favor of outpatient centers. In 2021, Tenet expanded its outpatient portfolio by acquiring USPI, one of the nation’s largest ASC networks. Ascension is in the process of buying another ASC company, AmSurg.

The increase in ambulatory care is driven by several factors:

Cost-effectiveness and safety

Patient convenience and preference

Surgical and anesthetic advancements

Regulatory support for non-hospital care

Employer and payer incentives

Innovators understand the compelling economics of the shift and are taking steps to address safety concerns. As momentum builds, the outpatient shift is certain to continue.

Compelling Economics

Shifting care to lower-cost sites-of-service is one of the fastest ways to reduce healthcare spending. The same test or procedure can cost 40-60% more when performed in an inpatient or hospital outpatient department (HOPD) versus an ASC, physician office, or independent facility. For services like infusions and imaging, the markup can be astronomical, often without any clear quality or safety advantage.

On average, HOPD facility fees are more than double ASC facility fees for common outpatient procedures. In some cases, HOPD prices can be up to 5x higher than their ASC or office-based equivalents. What’s more, HOPD prices are increasing at a much faster rate—up 27% on average compared to 11% for ASCs and 2% for physician offices. Consolidation worsens the problem: independent facilities are often reclassified to HOPDs post-acquisition, triggering higher fees without any change in care delivery.

Employers and health plans, desperate to pull every cost-saving lever, are increasingly forming relationships with narrow networks, high-value Centers of Excellence, and cost-efficient facilities. By redesigning networks, offering employee benefits, and engaging in direct contracting, they can steer patients to higher value care (same or better quality, lower cost). As more dollars flow toward cost-effective sites of service, those who deliver high-quality care outside the hospital will set the rules of engagement.

This shift also creates a more transparent, patient- and physician-friendly system. Physician ownership of ambulatory centers is one of the few viable ways to offset declining professional fees. Meanwhile, patients are becoming more sophisticated healthcare consumers. Convenience matters: ambulatory settings offer shorter wait times, better cost transparency, and a more personalized experience.

Addressing Safety Concerns

Concerns about ASC safety and accessibility are valid: not all tests or procedures are appropriate for ambulatory settings. But that paradigm is shifting. In a recent JAMA survey, clinicians indicated that 10-11% of commercial and Medicare volume could be safely shifted to lower-acuity settings without compromising outcomes. Patient selection remains critical, but improvements in technology, patient optimization, and clinical protocols are expanding eligibility.

Appropriate patient selection remains critical to safely performing higher complexity cases in an ASC. But the idea that HOPDs or inpatient settings are inherently safer may not be true. Properly selected patients undergoing hernia surgery, gallbladder removal, open breast procedures, and higher-risk procedures in an ASC had fewer revisits and complications than matched HOPD patients.

Demonstrating the safety of ambulatory procedures remains a significant focus of research across all specialties. Early results are promising. Patient selection criteria are evolving to include a broader range of patients. The responsible shift of care to ambulatory settings can be facilitated by embracing our second pillar of next-generation care: technology.

T is for Technology

Tech-enabled care is quickly becoming table stakes, next-generation model or not. Technology now sits at the center of almost everyone’s care delivery strategic roadmap. There’s only one problem: infrastructure and implementation haven’t caught up with enthusiasm. A recent survey of 34 major U.S. health systems found that only 16% had a systemwide AI governance policy in place. Only 6% admitted to having a generative AI strategy at all.

Meanwhile, independent practices struggle with rising overhead costs and the need for clear ROI on any new expense. They’ve been stung by the inefficiency, expense, and workflow disruption caused by EMRs. As a result, their appetite for adding fancy new tech tools is low, raising the barrier of entry.

Most understand that a tech wave is coming to healthcare—they just aren’t sure how to act. They know they have to do something, but they’re not sure what. Without strategy, structure, and clarity, layering technology on top of outdated processes adds friction. Developing a logical implementation is critical to success.

Technology isn't a panacea, but when deployed purposefully, it’s a key component of next-generation care. Done right, tech enables access, improves decision-making, reduces variation, and facilitates personalized care.

Digital Infrastructure and AI

The promise of AI is already being translated into real-world applications. A large language model called NYUTron helped predict hospital readmissions with 80% accuracy using unprocessed EHR text. Safety-net systems using AI to automate discharge planning and care coordination can reduce readmissions while improving equity and delivering significant cost savings. There’s still room for improvement—gains in both cases were meaningful but modest. AI/ML models used to predict surgical complications have variable rates of precision. Concerns about reliability, transparency, liability, ethics, and biases remain and need to be addressed.

Ambient scribes have received much attention and significant funding. Abridge recently raised another $300 million at an astonishing $5.2 billion valuation. Ambient technology overcomes two major barriers to entry—workflow disruption and clinician skepticism. Still, the ocean is red, and ambient AI companies must develop additional use cases to match investor and clinician expectations.

AI agents are one such potential use case. Agentic models proactively run campaigns: managing follow-up scheduling, closing care gaps, and handling patient outreach. This frees healthcare workers from the mundane, repetitive tasks that contribute to burnout and inefficiency. In a next-gen model, AI won’t just document the visit, it will coordinate next steps, surface the right information, and ensure seamless care continuity. Such a system is a win for doctors, medical staff, and patients alike.

Advanced Clinical Technologies

The tech revolution extends beyond AI and digital tools. Implementation of surgical robotics continues with applications in Urology, Gynecology, Orthopedics, Spine, and General Surgery. These platforms can improve precision, ergonomics, and reproducibility. Combining preoperative planning, intraoperative imaging, and data-driven insights enables more personalized surgical care. The ROI on surgical robotics has been challenged. But the field is rapidly evolving, and the next wave of robotics will answer those challenges.

Implants are evolving, too. Cervical and lumbar disc replacements offer viable alternatives to fusion, offering motion preservation and at least equivocal outcomes. Some knee replacements now incorporate biosensors. Minimally invasive procedures like transcatheter aortic valve replacement (TAVR) and the Watchman procedure are revolutionizing cardiac care.

Diagnostic technology is following a similar path. Low-radiation, high-resolution CT, functional MRI, AI-enhanced diagnostic platforms, and advanced blood tests are changing how we stage and monitor disease. They allow for early detection, produce actionable results, and facilitate focused, personalized interventions. Harnessing novel diagnostic technologies will reshape care delivery and move us toward a system that prevents rather than reacts.

The potential of advanced clinical technologies is enormous. But med tech history is littered with unfulfilled promises and hype that never matches reality. Taking full advantage of technology’s potential requires proper infrastructure and thoughtful implementation.

The Implementation Challenge

Tools are only as effective as the systems around them. Getting it right remains a struggle. The IBM Watson for Oncology program, once seen as a flagship application of AI in medicine, was shuttered after it repeatedly delivered inaccurate or unsafe recommendations. Memora Health, which raised over $40 million to automate care navigation, faced execution challenges. The company was acquired by Commure in what has been described as a “firesale.”

Traditional healthcare simply wasn’t built for tech-native workflows. Retrofitting new tools onto legacy models of care delivery has been a necessary but imperfect solution. Ultimately, doing so fails to capture tech’s full potential. The real opportunity lies in reimagining care delivery to be inherently tech-enabled. That means embedding AI, digital tools, and ambient data capture directly into the clinical workflows rather than treating them as add-ons. It requires the expertise to safely and effectively adopt novel implants and diagnostic technologies.

Despite technology’s revolutionary potential, widespread uncertainty around readiness persists. According to McKinsey, most health systems lack the foundational data literacy, infrastructure, and governance needed to scale these tools safely and effectively. The “tech-in-healthcare” movement continues to gather steam. But some didn’t make it onboard and are left figuring out how to jump on a moving train—still better than being hit by it. Advantage goes to early adopters and innovators already down the track.

In the ATV model, Technology serves as the connective tissue of next-generation care. It enables a safe shift to Ambulatory care, powers the insights and efficiencies that deliver Value, and helps the system deliver care that is more consistent, personalized, and sustainable. The critical differentiator will be the ability to build the right system around it.

That brings us to our final pillar: V is for Value.

V is for Value

Value, at its core, is simple: deliver high-quality care while reducing systemic cost. A $25,000 knee replacement done in an ASC with an excellent outcome and significant cost savings is high-value, even in an FFS arrangement. A well-indicated spine surgery unnecessarily delayed for months because a capitated model incentivizes procedural avoidance is low-value.

Early in my career, I didn't think much about "value." I did my best for patients, followed evidence-based practices, and relied on judgment and experience. When that failed, I reached out to someone smarter than me. That approach delivered a lot of value for a lot of patients, long before I ever heard the phrase "value-based care."

Despite backlash and buzzword fatigue, VBC isn’t going away. Rather than abandon a struggling concept, next-generation care will figure out how to overcome its shortcomings and make it work.

VBC Reality Check

A decade into the "VBC era," we're coming out the other side bruised, battered, and jaded. A few years ago, CMS launched the Bundled Payments for Care Improvement–Advanced (BPCI-A) program. It became my first foray into "value-based care." In truth, I didn't need to change much to be successful. I was already sending patients home instead of to rehab, not necessarily because of cost saving, but because studies showed that home discharge was safer (most patients hated rehab facilities anyway). I was already minimizing readmissions by optimizing patients for surgery, knowing my limits, and erring slightly on the side of caution (no cherry-picking or lemon-dropping needed).

A few VBC programs have been successful, but most have fallen flat. CMMI's own data shows that most of their alternative payment models haven't generated direct Medicare savings. Two-thirds of the program models yielded no savings or generated substantial net losses. Too often, value-based care became synonymous with administrative burden, convoluted metrics, and payment mechanisms divorced from clinical realities. The upcoming mandatory Transforming Episode Accountability Model (TEAM) has hospitals scrambling—many are projected to lose money in the program.

The concept of "value" isn't wrong—we just haven't figured out how to capture its essence. Worse yet, we've fooled ourselves into believing that payment models, risk-shifting, and ratchet mechanisms are the answer. The term "value" has become politicized, overused, and diluted. It means everything and nothing.

It doesn’t have to be that way.

Creating Inherent Value

Value-based thinking shouldn’t be abandoned. Instead, we should design systems where value emerges naturally from the care model itself, rather than being imposed through external payment mechanisms.

Despite the backlash towards VBC, it's here to stay, and it can be done well. Scott Conard's work in primary care shows that proactive, relationship-driven medicine reduces downstream costs and improves health. In surgical care, tightly integrated bundles, where patient optimization, perioperative care, and recovery are managed under one roof, lower costs without a decline in quality. When designed with input from all stakeholders and proper reward mechanisms, these programs have merit.

The “value” debate will continue. We'll bounce from one acronym-heavy program to the next. But real value is innate, not forced by external pressures. In short, value doesn't create you. You create value.

No matter the payment model—FFS, bundled payments, shared savings, or downside risk—value is a byproduct of delivering high-quality care, following the evidence, developing efficient processes, and designing clinical pathways based on sound medicine. No payment model can force that into existence.

The ATV Unlock

Next-generation care models will emerge to achieve our intended goals naturally. They'll build tightly integrated systems centered around Ambulatory settings with lower costs and better patient experiences. Layering in intelligent Technology infrastructure will facilitate this shift while reducing variation and improving outcomes. When these elements work together, "VBC” will inherently create Value for the patient, the clinician, and the system.

As care evolves, the three pillars of ATV support and amplify each other. Ambulatory settings provide the cost-effective foundation. Technology enables the precision and efficiency needed to make complex ambulatory care safe. Together, they create a system where Value emerges from the structure rather than being imposed externally.

As models evolve and become more sophisticated, we'll see a shift to condition-specific episodes that capture value across the entire care journey. Great care should be the focus, not complexity, administrative burden, spurious metrics, and bait-and-switch reconciliation payments. The tools for transformation already exist—they just need to be assembled thoughtfully, with strategy, structure, and clarity.

The ATV model unlocks this potential.

I love it! Are there any areas/workflows where you see AI agents being able to provide early value?